FAQs

Q. What is the difference between Federal Subsidized and Unsubsidized Loans?

- Subsidized:The federal government pays the interest on a subsidized loan as long as the student is in school at least half-time. After the student drops below half-time or leaves school, interest will begin to accrue.

- Unsubsidized: Interest begins to accrue from the moment an unsubsidized loan is disbursed.

Q. How does my parent apply for a parent PLUS loan?

- Parents can apply for Federal PLUS Loan at www.studentloans.gov using their FSA ID.

Q.How do I accept my awards online?

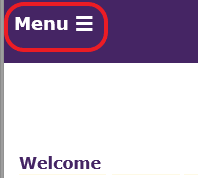

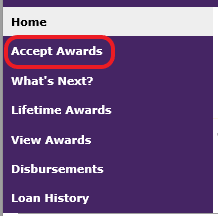

1.) Log in to My Financial Aid through Trinity Self Service.2.) Select the menu drop down on the left-hand side of the page and select “Accept Awards.”

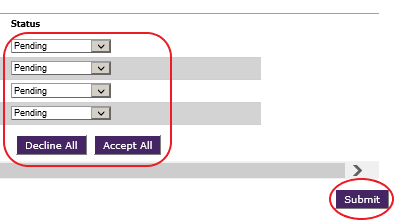

3.) Scroll down to the bottom of the page, and accept and/or decline awards as desired. Click submit.

Q. How do I get my Tax Return Transcript?

- You can order a tax return transcript by completing the 4506-T form linked below.

Q. How do I set up a payment plan?

- Students can set up a Nelnet Payment Plan by logging clicking on the shopping cart for Trinity Self-Service and selecting “Payment Plans” under “My Finances.”

Q. How do I link my tax information to the FAFSA using the Data Retrieval Tool?

- Select Link to IRS

- Proceed to the IRS Site

- Enter your information exactly as it appears on the tax return for the required year. Click submit.

Q. Who do I contact if I have questions about repaying my federal direct loan?

- Students can review all of the information regarding their loans and any grants they received at https://nslds.ed.gov/nslds/nslds_SA/

Note: You will need your FSA ID to log in.